But the danger of setting inequality and immobility in opposition is that they're not in opposition. Matthew O'Brien has

written eloquently on "opportunity hoarding," the idea that rich people are talented at doing all the right things you need to stay rich and make sure your kids get rich, too. Rich couples live in richer districts, read more to their kids, send them to better schools, hook them up with better internships, slide them into better entry-level jobs (or, better yet, into the family business), and finally pass down their insured and well invested wealth. Even education, the great American equalizer, makes for a poor equalizer. And it's not only because wealthy teenagers are more likely to go to school. Young people born to rich families who don't go to college are

2.5 times more likely to end up in the richest quartile than young people born to poor families who

do go college. Wealth sticks, and nothing enriches like richness.

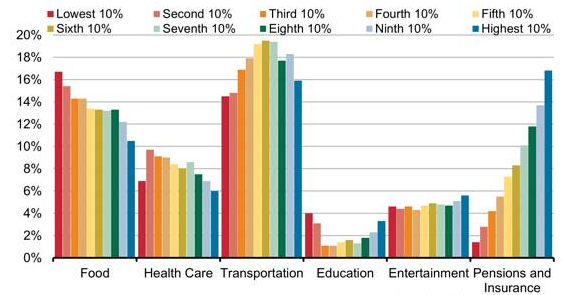

It's boring to point out that having more money affords you more food, more clothes, more housing, and more cars. But the richest families actually spend less on food, clothes, housing, and cars than the poorest families as a share of their income. The real difference between the rich and the poor is that the rich spend a larger share of their much larger income on insurance, education, and, when you drill into the housing component, mortgages—all of which are directly related to building wealth, preserving wealth, and passing it down in the form of inheritance of direct investments in the lives of their children.